What are the differences between employees and independent contractors?

Avoid worker misclassification by understanding the differences.

Understanding the differences between employee and independent contractors is about more than semantics. It presents a number of compliance issues that can land organisations in hot water if workers are not classified correctly.

We have seen this in landmark employment tribunals – most notably with large brands such as Uber, who went to court after misclassifying workers as self-employed.

So, what is the difference between a contractor and an employee? How can organisations treat their workers fairly and avoid legal action?

The definition of employee or contractor

The differences between contractor and employee can present some semantic arguments. For example, according to the UK’s HMRC:

- An independent contractor works for a client under a contract for services

- An employee works under a contract of services

Two small words can make all the difference, but there’s more to it than that. Other ways to distinguish an independent contractor vs an employee would be to look at that person’s role within an organisation.

What is the difference between employee and independent contractor?

Let’s look at how you might define each role separately.

The role of an independent contractor

An independent contractor’s role will typically comprise working on a specific task or project. They do not have an employment relationship with the company. This means they may have more autonomy over what they do but are still responsible for delivering a product or service to you as the client.

They may have a particular skillset or be contracted to work for a specific time period, for example, for the duration of the project.

Crucially, a key difference between an independent contractor and an employee is that an independent contractor has the right to substitute themselves for somebody else – for example, an employee in the contractor’s own business.

The role of an employee

An employee’s role generally has less autonomy than a contractor’s – they are employed and answerable to their line manager. They are contracted under certain hours (though this may be more flexible with some employers than others) and they work under the guidance of their manager.

What are the penalties for misclassification?

If you don’t classify workers correctly, you may find that there are several potential consequences. These might include:

- Reputational damage for treating workers incorrectly

- Breaching employment law

- Potential legal sanctions

- Losing licences or regulatory approvals

- Financial losses from fines or penalties.

Working with an independent contractor solutions provider is often a good idea, helping you classify workers correctly without risking penalties.

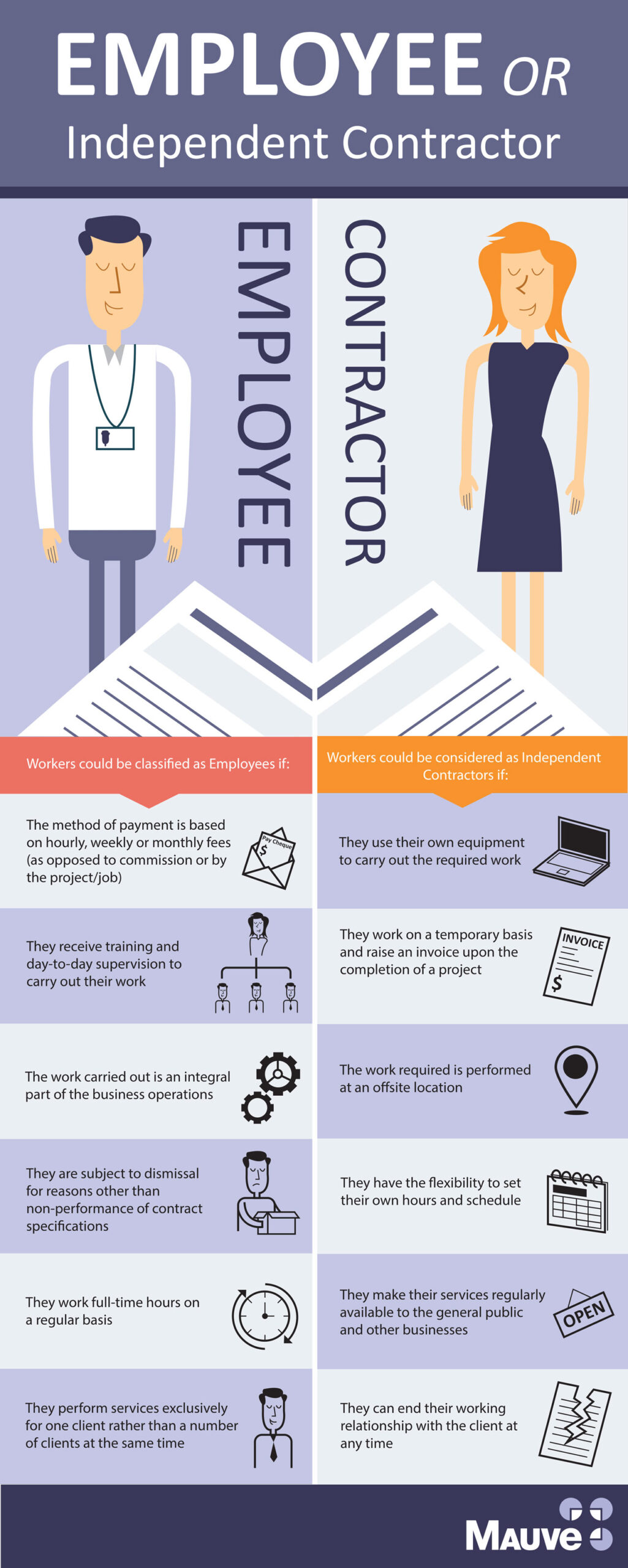

Independent contractor vs employee: The key differences

There are several things to consider when looking at the differences between contractor and employee.

Working practices

How are the working practices defined? For an employee, you’ll probably set specific working hours per week, or a total number of hours per day. You’ll have a level of control over day-to-day schedules. Often, you’ll provide an office for the worker – although remote working is increasingly common. An independent contractor will usually work on their own schedule, remotely, and on a short-term basis.

The contractual worker status

Do you have a contract in place? Employees typically receive a written contract following employment law. This employment contract can cover many legal and working issues. With a contractor, you may have no contract at all. As independent contractors run their own businesses, both parties have fewer protections in a contractor relationship.

How and when you pay

Next, consider how you pay the worker. Employees usually agree a yearly salary or hourly rate, following laws around remuneration including minimum wage. Employees’ compensation is generally paid at the same point on a regular schedule. However, this depends on the laws of the country – in some countries’ labour law, the specific date is payment is defined.

Contractors’ payments will be whatever is agreed with the client, usually defined in a contract.

How you manage taxes

Are you involved in the worker’s tax affairs? In many countries, for employees on a local payroll, employers will typically manage income tax, national insurance and other employment tax contributions. In others, such as Hong Kong and Singapore, employees have to submit their own tax returns. An independent contractor manages their own taxes.

The benefits you provide

Are there any benefits for the worker? For employees, benefits range from:

- Pension plans

- Health insurance

- Childcare allowance

- Professional development

- Fitness or health and lifestyle incentives

- Flexible and remote working options

- Life insurance.

These are given on top of their regular remuneration. Independent contractors do not receive benefits. It’s strictly a business relationship, so a contractor handles their own pension, insurance, and other allowances.

The equipment you provide

Do you provide the worker with equipment to do the job? For an employee, you’ll probably provide all the equipment – including computing equipment – for them to work. This can also include office space. As part of the contractor agreement, the independent worker will usually provide their own equipment and often works offsite.

How you manage the schedule

Do you set the work schedule? In an employment relationship, you’ll have a large degree of control over the daily schedule. You might establish working hours with an arrival and finish time. Independent contractors, on the other hand, are their own business owners, so usually work to their own schedule.

How you manage expenses

Finally, how do you pay business expenses? When an employee incurs business expenses, they will either use a business card or submit a request for reimbursement. Reimbursements can often be paid to the employee alongside their salary payroll. An independent contractor has their own small business, so will run business expenses through it. There may sometimes be an agreement that contractors can claim some expenses when working for a company, so they will invoice the company for business expenses.

Employee or contractor?

The differences between employee and independent contractor might include:

- How and when you make payments

- How much control you have over schedules

- If you provide any equipment, benefits, or support.

As there are severe penalties for worker misclassification, it’s essential to make the distinction. Is your worker an employee or contractor? At Mauve, our independent contractor solutions help you get it right. Contact us today for more information.

Salary benchmarking tools compared: spreadsheets vs software vs consultancy

Spreadsheets, software, or consultants? Compare salary benchmarking tools by cost, scalability, accuracy, and long-term value for successful global hiring and retention.

How often should you update salary benchmarks? A payroll calendar for HR teams

Keep your pay strategy competitive and compliant. Learn how often to update salary benchmarks and use a practical payroll calendar to guide smarter HR decisions.